Stamp Duty And Property Registration Charges In Up In 2024

Purchasing a property is a significant milestone, and for homebuyers in Uttar Pradesh (UP), understanding the financial obligations involved is crucial. When registering a property, buyers must be aware of the stamp duty and registration fees set by the government. These charges are essential for the legal recognition and transfer of property ownership.

In 2024, the Uttar Pradesh government continues to enforce specific rates for stamp duty and property registration. These costs are not just a formality but are crucial in ensuring that the property transfer is legally binding and properly documented. With varying rates depending on the property’s location, buyer profile, and transaction type, it’s important to stay informed about the latest regulations and fees.

This guide aims to provide a clear overview of the stamp duty rates and registration fees applicable for property registration in UP this year. Whether you’re a first-time homebuyer or looking to register an inherited property, understanding these charges will help you navigate the property registration process more effectively and avoid unexpected costs.

Stamp Duty in UP

Stamp duty charges in Uttar Pradesh are a crucial aspect of property registration. These charges vary depending on several factors including the property’s location and the buyer’s profile. In UP, the stamp duty in UP for residential properties is generally a percentage of the property’s value. The UP stamp duty rates are updated periodically, so it’s important to check the latest rates before making any transactions.

For female buyers, there is a slightly reduced rate. Stamp duty in UP for female buyers is generally lower compared to the standard rate, providing some financial relief. Additionally, property registration charges in UP for female buyers benefit from this concession, making it more affordable.

Registration Charges in UP

Registry charges in UP are another component of the overall cost of property registration. These charges cover the administrative costs associated with processing the property registration. The registry charges in Lucknow may vary slightly from other regions within UP, but generally align with the state’s standard rates.

The registration charges of property in UP are calculated based on the property’s value and the type of transaction. This includes registry fees in UP and other related costs. It’s advisable to consult the local registry office or a legal expert to get precise information about registry fee in UP for your specific case.

Additional Costs

Aside from the standard stamp duty and registration fees, there are other costs to consider. For instance, stamp duty on partition deed in Uttar Pradesh might have different rates compared to general property registration. Similarly, up registry charges and registry charge in UP for specific documents might differ.

To summarize, the total cost of property registration in Uttar Pradesh includes both stamp duty and registration charges in Uttar Pradesh. Buyers should be aware of the up property registration charges and ensure they budget for both up stamp duty rates and registry price in UP. Keeping up-to-date with the latest regulations and rates will help in making informed decisions during property transactions.

Stamp duty, registration fee on property registry in UP in 2024

| Owner | Stamp duty as percentage of the property value | Stamp duty as a percentage of the property value | Stamp duty and registration charge in Rupees on a property worth Rs 10 lakh |

| Man | 7% | 1% | Rs 70,000 + Rs 10,000 |

| Woman | 6%* | 1% | Rs 50,000* + Rs 10,000 |

| Man + woman | 6.5% | 1% | Rs 65,000 + Rs 10,000 |

| Man + Man | 7% | 1% | Rs 70,000 + Rs 10,000 |

| Woman + woman | 6% | 1% | Rs 50,000* + Rs 10,000 |

Please note the following important points regarding property registration in Uttar Pradesh (UP):

1. Stamp Duty Rebate for Women:

- Women are eligible for a 1% reduction in stamp duty charges on property transactions in UP. This rebate applies to the first Rs 10 lakh of the transaction value.

2. Circle Rates:

- Property cannot be registered below the government-determined circle rates in any state, including UP.

- If the property’s transaction value is lower than the circle rate, stamp duty is calculated based on the circle rate, not the transaction value.

These guidelines ensure compliance with state regulations and help clarify the process for property buyers in Uttar Pradesh.

Stamp duty on other deeds in UP in 2024

| Documents to be registered | Stamp duty in Rs |

| Gift deed | *5% of the property value**Rs 5,000 in case of gifting in family members |

| Will | Rs 200 |

| Exchange deed | 3% |

| Lease deed | Rs 200 |

| Agreement | Rs 10 |

| Adoption deed | Rs 100 |

| Divorce | Rs 50 |

| Bond | Rs 200 |

| Affidavit | Rs 10 |

| Notary | Rs 10 |

| Special power of attorney | Rs 100 |

| General power of attorney | Rs 10 to Rs 100 |

Stamp duty on property gifting within a family in UP in 2024

In Uttar Pradesh, property transfers among blood relatives now attract a reduced stamp duty of Rs 5,000 following the passage of the Indian Stamp (Uttar Pradesh Amendment) Bill-2024. This bill, approved by the Uttar Pradesh Assembly on February 9, allows for property transfers between blood relatives with a stamp duty of Rs 5,000. Additionally, a processing fee of Rs 1,000 is also required, making the total cost Rs 6,000 for such transactions.

The Uttar Pradesh Cabinet, in a decision on June 15, 2022, chaired by Chief Minister Yogi Adityanath, further reduced the stamp duty and registration charges for family property transfers to a total of Rs 7,000. This includes Rs 6,000 for stamp duty and Rs 1,000 for processing fees. It’s important to note that this reduced stamp duty is applicable for a limited period of six months and applies specifically to certain types of property transfers among family members.

Who are family members for this purpose?

The reduced charges will be applicable only on property transfers to one’s

- Father

- Mother

- Brother

- Sister

- Spouse

- Son

- Daughter

- Son-in-law

- Daughter-in-law

- Grand children from son’s as well as daughter’s side

Earlier in Uttar Pradesh (UP), property owners faced a significant burden with a 7% stamp duty on property transfers within their family, coupled with a 1% registration charge. For instance, on a property valued at one crore rupees, owners were required to pay Rs 8 lakh in stamp duty and registration charges, even when transferring assets to family members without monetary exchange.

The high stamp duty rates led many property owners in UP to opt for transferring properties within the family through a power of attorney, which incurred a minimal fee of only Rs 100. This practice resulted in substantial revenue loss for the state government. Moreover, the steep rates discouraged property owners from transferring their properties among family members during their lifetimes.

To legally transfer property among family members in UP, options include drafting and executing a gift deed, relinquishment deed, or partition deed.

Stamp duty for Women in UP

In Uttar Pradesh (UP), women benefit from a reduced stamp duty rate on property registrations, but this discount applies only to properties below a specified price threshold. While men typically pay a 7% stamp duty, women pay a reduced rate of 6% on properties valued at Rs 10 lakh or less. However, for properties exceeding Rs 10 lakh, both men and women are subject to the same 7% stamp duty rate.

Property registration charge in UP in 2024

In 2020, the Uttar Pradesh government revised its stamp duty rates and registration fees for property transactions, eliminating the previous cap of Rs 20,000. Currently, the registration fee is calculated at 1% of the sale consideration. For instance, if a property valued at Rs 50 lakhs is being registered, the buyer would need to allocate Rs 50,000 for the registration charge.

Stamp duty UP calculation example

Ram Singh is purchasing a property with an 800 sq ft carpet area in a location where the circle rate is Rs 5,000 per sq ft. Therefore, the circle rate-based value of the property is calculated as 800 x 5,000 = Rs 40 lakhs.

If Ram registers the property at this circle rate value of Rs 40 lakhs, he will be required to pay stamp duty at the rate of 7%. This amounts to Rs 2.80 lakhs.

Even if Ram registers the property at a lower amount, he will still need to pay stamp duty based on the circle rate value of Rs 40 lakhs, as registering below the circle rate is not permissible. For example, if the property is registered at Rs 50 lakhs, Ram will pay stamp duty calculated at 7% of Rs 50 lakhs, totaling Rs 3.50 lakhs.

Additionally, Ram Singh must pay a registration charge of Rs 50,000 for the property registration process.

How to pay stamp duty online in UP?

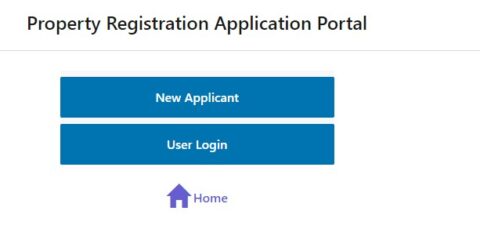

you can find the Stamp and Registration Department UP portal by searching for it directly in your web browser https://igrsup.gov.in/. Once on the portal, look for language options or navigation aids that allow you to switch to English if the page initially opens in Hindi.

To apply for registration and create an application number on the Stamp and Registration Department UP portal, follow these general steps (assuming the process remains similar):

- Visit the Portal: Go to the Stamp and Registration Department UP portal through your web browser.

- Navigate to New Application: Look for an option labeled ‘New Application’ or similar. This is typically found in the main menu or on the homepage of the portal.

- Fill Out Application Form: Click on the ‘New Application’ option. You will be directed to an application form. Fill out the form with all required details accurately. This may include personal information, property details, transaction details, etc.

- Upload Documents: Upload any required documents as specified in the application form. This might include identity proofs, property documents, proof of payment, etc.

- Submit the Application: After completing the form and uploading necessary documents, review all information to ensure accuracy. Then, submit the application.

- Receive Application Number: Upon successful submission, the portal should generate an application number. This number serves as a reference for tracking your application status.

- Payment of Fees: Depending on the portal’s process, you may need to pay the required fees online or through designated payment methods. Follow the instructions provided on the portal.

- Track Application: Use the application number to track the status of your registration application on the portal.

Since processes and interfaces can vary, it’s advisable to carefully follow the instructions provided on the Stamp and Registration Department UP portal for the most accurate guidance.

After successfully registering with your credentials, you can log in as a registered user. From there, you’ll need to enter details about the property, the buyer, the seller, and the witnesses. Once all information is entered, the system will automatically compute the stamp duty and registration charges applicable to your property. After making the payment for stamp duty, a receipt number will be generated. It’s crucial to save this number for future reference. Additionally, you should schedule an appointment for property registration at the sub-registrar’s office.

Property registration at sub-registrar’s office in UP

Following the online payment of stamp duty, both the buyer and the seller, accompanied by two witnesses, are required to visit the Sub Registrar’s Office (SRO). At the SRO, property registration proceeds in two stages, overseen by different officials.

Firstly, an Operator at the SRO verifies the details provided in your online application, capturing your thumb impressions and photo.

Secondly, the sub-registrar reviews all the information in your application and compares it with your original documents to ensure accuracy and completeness.

Is paying stamp duty on property registration a must in UP?

For any property valued at more than Rs 100, the buyer must pay stamp duty and registration charges to officially register the transaction in the government’s records. This requirement is mandated by the provisions of the Registration Act of 1908. Failure to register the transaction means that the property exchange between the buyer and the seller lacks legal sanction, depriving the buyer of legal ownership of the property title. Additionally, non-registration constitutes non-compliance with the law and may incur monetary penalties.

UP stamp duty office contact information

- Stamps and Registration Department,

- 2nd Floor, Vishwas complex,

- Vishwas Khand -3, Gomti Nagar, Lucknow, 226010

UP to implement e-registration in 2 phases

While reviewing the Online Registration Rules 2024, Uttar Pradesh Chief Minister Yogi Adityanath emphasized the implementation of e-registration across the state. He directed the stamp and registration department to expedite the drafting of e-registration guidelines. Stressing the importance of e-registration, the chief minister highlighted that it will be introduced in two phases to meet the current demands effectively.

Stamp duty on gift deed can’t be based on market value: HC

The Allahabad High Court has ruled that stamp duty on gift deeds should be based on the property’s value rather than its market value. The court’s decision stated that Section 47-A (3) of the Indian Stamp Act, which deals with undervalued instruments, does not apply to property transferred through gift deeds.

Section 47-A (3) outlines the procedure for handling undervalued instruments, requiring the Collector to determine the market value of the property through an inquiry and to levy duty accordingly. However, the court clarified that this provision does not extend to transactions involving gift deeds, where the duty is to be assessed solely based on the property’s value as specified in the deed itself.

Stamp duty payment deficiency, burden of proof lies with SRO: HC

In a recent ruling in the case of Raj Kumar versus State Of UP And Others, the Allahabad High Court has clarified that in instances where the registrar’s office seeks to impose deficient stamp duty on a homebuyer, the burden of proof rests squarely on the office and not on the buyer.

The court emphasized that once the state initiates action to impose deficient stamp duty on a petitioner, it is incumbent upon the state to establish beyond reasonable doubt that the petitioner either concealed information at the time of executing the sale deed or that there was a recent change in the land use, warranting additional stamp duty. The court noted that no such evidence was presented, and it criticized the findings in the impugned orders for being contrary to the provisions of the Indian Stamp Act, 1899, applicable in Uttar Pradesh, as well as the UP Stamp (Valuation of Property) Rules, 1997, and the established legal principles consistently upheld by the court.

Frequently Ask Questions

Can I pay stamp duty online in UP?

Yes, stamp duty can be paid online in Uttar Pradesh through the Stamp and Registration Department’s official portal.

What is the registration charge on property purchase in UP?

The registration charge in Uttar Pradesh is currently 1% of the property’s transaction value.

How much stamp duty has to be paid on joint property in Lucknow?

Stamp duty rates in Uttar Pradesh are typically uniform across the state. For joint property transactions, each party involved would be liable to pay stamp duty based on their respective share in the property.

Who pays stamp duty on property?

Stamp duty is generally paid by the buyer of the property, although in some cases, agreements may specify otherwise. The responsibility for payment is legally with the buyer unless agreed otherwise between the parties.

When is stamp duty payable?

Stamp duty is payable at the time of executing a property transaction, typically when the sale deed or conveyance deed is registered.

Where can I find more information about stamp duty rates and regulations?

More detailed information about stamp duty rates and regulations in Uttar Pradesh can be found on the official website of the Stamp and Registration Department of Uttar Pradesh or through local sub-registrar offices.

What are the consequences of not paying stamp duty?

Not paying stamp duty can have serious legal consequences. The transaction may be deemed incomplete and legally invalid, which means the buyer may not have legal ownership rights over the property.